6 characteristics of Market Development

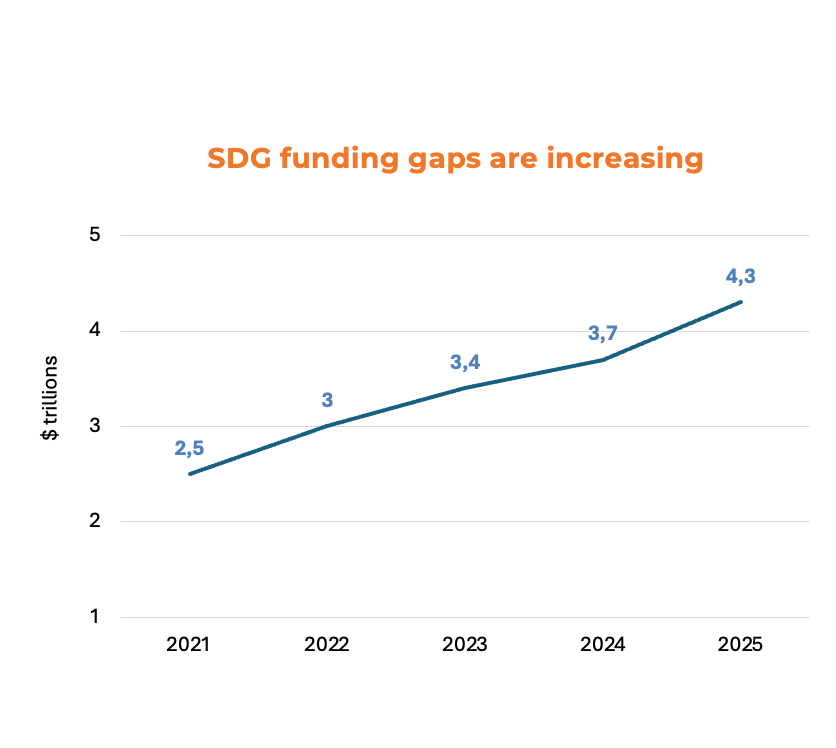

Market Development in the Impact Investing space is an emerging practice and not well delineated. In the core it is about building investable pipeline for impact investors – but it goes further then making individual companies investable or bankable. It’s about unlocking the potential of entrepreneurship to find new solutions to persisting challenges. It’s about scaling these solutions across geographies to promote impact at scale – which requires a systemic approach. The toolbox is endless – ranging from grant-making to investment and the art is to understand what to use when. Market Development is an incredible heavy lift – which can only be done successfully in collaboration with other partners. And last but not least, it requires flexible operating structures that allow to blend instruments and respond to market dynamics.

A typology of Market Development in 6 characteristics:

The Market Development Accelerator