The Wonderful Emerging practice of

Market Development

Market Development in the Impact Investing space is an emerging practice. In order to support the evolution of this important and exciting field of work and shorten the learning curve – we have started this modest repository.

Nascent field of work

In the core Market Development is about generating pipeline of impactful investment opportunities for investors – but it goes further then making individual companies investable or bankable. It’s about unlocking the potential of entrepreneurship to find new solutions to persisting challenges. It’s about replicating these solutions across markets to scale impact – taking systemic approach, changing behavioural patterns and support evolving ecosystems. The toolbox is endless – ranging from grant-making to investment and the art is to understand what to use when. Market Development is an incredible heavy lift – which can only be done successfully in collaboration with other partners. And last but not least, it requires flexible operating structures that allow to blend instruments and respond to market dynamics.

Repository

The market development practice is fairly broad and with that comes a certain level of complexity and need for learning. In order to help accelerate that learning and support its professionalisation as practice, we’ve created below repository. for the moment organised around five key topics: investable impact solutions, conceptual frameworks, tools&instruments, collaboration & structure.

But there is so much more – and we need your help to bring it all together. So, please if you find a relevant document, link, or experience, please share it with us. Also, if you have questions on content or suggestions for topics, please reach out.

Scaling Impact Markets

At the core of market development are investable and scalable impact solutions. Think of Microfinance, Green Mini-Grid, Off-grid Finance or SME that generate jobs. We can add so much more text after his.

The practice of scaling markets

One of the oldest pillars of the Impact Sector is Microfinance Sector. It offers a great illustration of how an investable solution was development and brought to scale.

Geography versus sector

So, what is the best way to delineate a market? Geographically or rather as sector? To give it away: from an investment perspective there is a slight preference for sectoral approaches – but geographies are equally important.

Interesting reads

Concepts & Frameworks

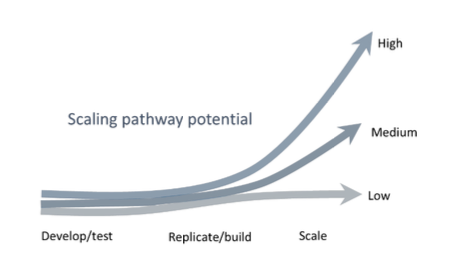

Market development typically takes three stage: innovation, replication and scale. Scaling potential depends on three factors.

A simple framework

Click here to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

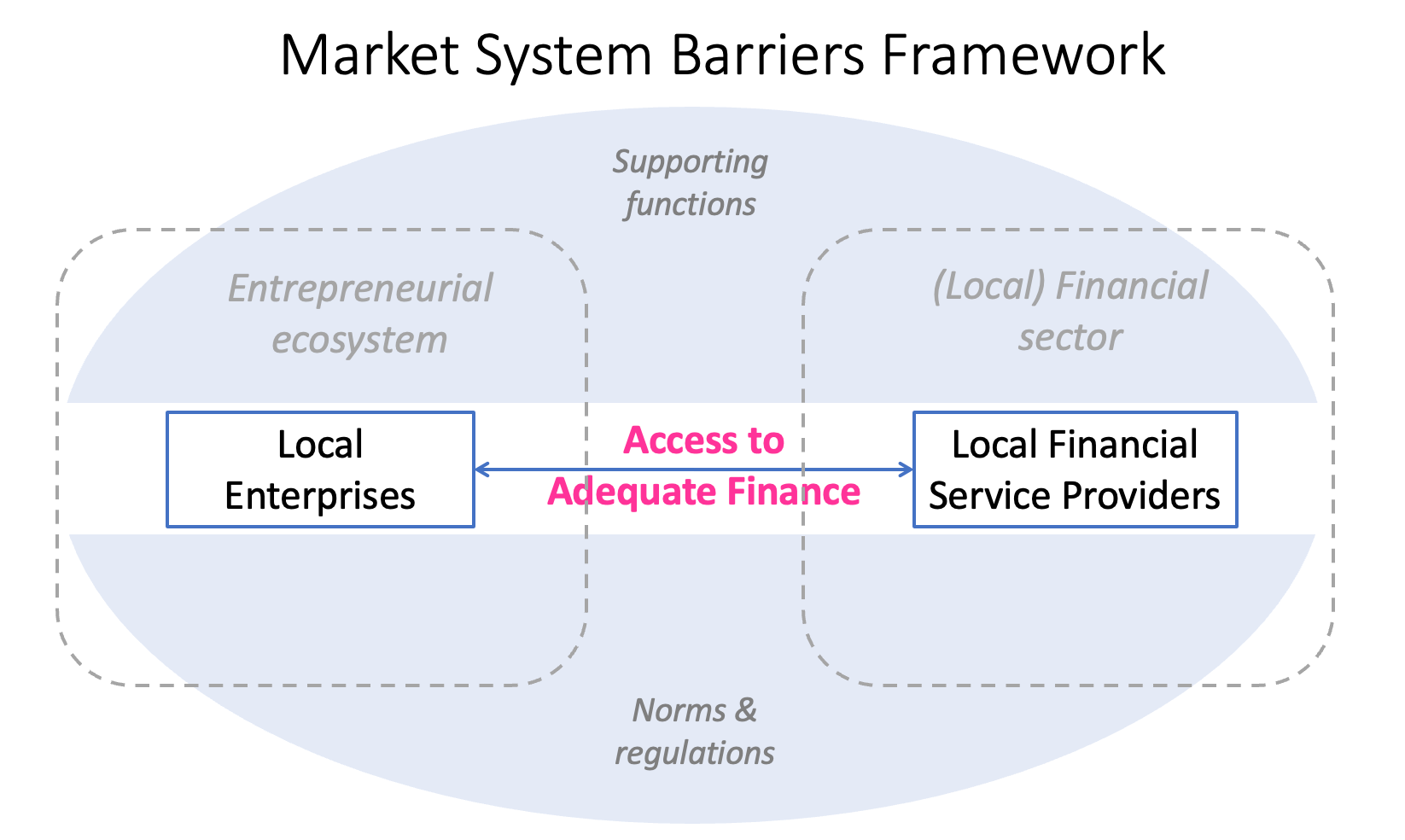

Taking a Market System Approach

A comprehensive approach helps to set targets and priorities, identify the right mix of of tools and instruments and collaboration partners

Mix of tool and instruments

Toolbox varies from investment to grant-making and from investment to influencing strategy. Challenge is to understand which tool and approach to use when.

Toolbox & staging

Click here to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Catalytic Capital & Market Development

Interesting reads

fdafda

Collaboration 3.0

Market Development is an extreme heavy lift. It requires deep forms of collaboration across disciplines and geographies.

Flexible Structures

Operating system strategies with a variety of tools and instruments requires operating structures and governing systems that are robust but flexible.

So, how can we accelerate Market Development?

It is a new field of work with little track record. There is a lot of tacit knowledge, but little has been recorded. Below an overview of the key obstacles and opportunities to accelerate market development in the impact investing space. In order to accelerate Market Development we need to push the Turbo Boost button